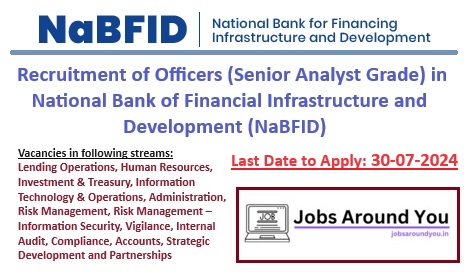

Online Applications are being invited from Indian Citizens for Officers (Senior Analyst Grade) in NaBFID Recruitment 2024

National Bank for Financing Infrastructure and Development (NaBFID) is inviting online applications from Indian Citizens for Officers(Senior Analyst Grade) under NaBFID Recruitment 2024 Drive.

National Bank for Financing Infrastructure and Development (NaBFID), set up under the NaBFID Act, 2021, and is amongst the principal entities for Infrastructure Financing in the country. The entity is regulated and supervised as an All-India Financial Institution (AIFI) by the Reserve Bank of India (RBI). NaBFID is poised to play an extremely crucial role in supporting infrastructure funding in the nation.

Below are the details of NaBFID Recruitment 2024 for Senior Analyst Grade:

| National Bank for Financing Infrastructure and Development Recruitment 2024 (NaBFID Recruitment 2024) of Officer (Senior Analyst Grade) jobsaroundyou.in | |||

| Application Mode | Online | ||

| Total Vacancies | 30 | ||

| Selection Process | An Online Exam and Personal Interview | ||

| Application Start Date | 10-Jul-2024 | ||

| Application and Fee payment Last Date | 30-Jul-2024 | ||

| Application Fee | General / EWS/ OBC candidates – ₹800/- plus applicable taxes SC / ST / PwBD candidates – ₹100/- plus applicable taxes | ||

| Tentative Date of Examination | August 2024* | ||

| *Exact date will be advised through the call letter and posting on the Bank’s website | |||

| Download of Examination Call Letters | 10 days before the Examination | ||

| Cut-off date for Eligibility Criteria i.e. Age, Educational Qualification etc. | 01-Jun-2024 | ||

| Age as on 01.06.2024 | Minimum 21 years, Maximum: 40 years | ||

| For Applying Online | Click Here or go to Official Website | ||

| For Detailed Notification | Click Here or Official Website | ||

| For Latest Updates (Official Website Link) | https://nabfid.org/careers | ||

| Stream | No of Vacancies (Category wise) | Total Vacancies | PwBD |

|---|---|---|---|

| Lending Operations | GEN – 6 SC – 1 OBC* – 2 EWS** – 1 | 10 | VI – 1 HI – 1 |

| Human Resources | GEN – 1 | 1 | |

| Investment & Treasury | GEN – 2 | 2 | |

| Information Technology & Operations | GEN – 2 | 2 | |

| Administration | GEN – 1 | 1 | |

| Risk Management | GEN – 4 SC – 1 OBC* – 1 EWS** – 1 | 7 | |

| Risk Management – Information Security | GEN – 2 | 2 | |

| Vigilance | GEN – 1 | 1 | |

| Internal Audit | GEN – 1 | 1 | |

| Compliance | GEN – 1 | 1 | |

| Accounts | GEN – 1 | 1 | |

| Strategic Development and Partnerships | GEN – 1 | 1 | |

Below are the Educational Qualifications & Post Qualification Experience for NaBFID Recruitment 2024 of Officers – Senior Analyst Grade:

| Stream | Educational Qualification & Post Qualification Experience |

|---|---|

| Lending Operations | Educational Qualification: Post-Graduate Degree / Diploma in Management with Specialization in Finance / Banking & Finance OR MBA (Finance/Banking & Finance) OR ICWA / CFA / CMA / CA from recognized University / Institution Post Qualification Experience: Minimum 4 years of experience in financial / corporate sector; out of which 2 years in mid / large corporate credit appraisals, operations, documentation, disbursement etc. |

| Human Resources | Educational Qualification: Post-Graduation Degree/ Diploma in Management with Specialization in Human Resources / Industrial Relations/Personnel Management from recognized University/ Institution Post Qualification Experience: Minimum 4 years of experience in HR functions in financial/corporate sector. |

| Investment & Treasury | Educational Qualification: Post-Graduate Degree/ Diploma in Management with Specialization in Finance/ Forex) OR MBA (Finance/ Banking & Finance) OR ICWA / CA / CFA from recognized University / Institution Desirable: Certification in Treasury / Forex Post Qualification Experience: Minimum 4 years of experience in financial / corporate sector; out of which 2 years in treasury functions / investment desk / asset liability management / back-office functions viz. settlements, reconciliation, valuation / forex & derivatives Desirable: Experience in fund-raising / institutional resources mobilization |

| Information Technology & Operations | Educational Qualification: MCA / MTech / M.E. OR Postgraduate degree/diploma in Computer Science / Computer Engineering, AI & ML, Software Engineering, IT, Electronics and Telecom from recognized university/ Institution Post Qualification Experience: Minimum 4 years of experience in Project Management / Application Maintenance / Business Support & Development / data governance / cloud infrastructure. Desirable: Experience in Financial/Fintech Sector |

| Administration | Educational Qualification: Postgraduate degree/diploma in any discipline from a recognized University / Institution. Desirable: Candidates having previous work experience in Administration Dept of any Govt Org or/and firsthand experience of working in GeM. Excellent Verbal and written communication skills. Post Qualification Experience: Minimum 4 years of experience in financial / corporate sector; out of which 2 years in administration department/ function |

| Risk Management | Educational Qualification: Post-Graduate Degree / Diploma in Management with Specialization in Finance / Banking & Finance OR MBA (Finance/Banking & Finance) OR ICWA / CFA / CA from recognized University / Institution Desirable: FRM or equivalent Risk Management Certification Post Qualification Experience: Minimum 4 years of experience in financial / corporate sector; out of which 2 years in risk management / ALM function / operational risk/credit risk/Market Risk/ credit monitoring. |

| Risk Management-Information Security | Educational Qualification: B.E./ B.Tech./ MCA/ M Sc/ Post Graduate Degree/Diploma with specialization in Computer Science/IT/Electronics & Communication/ Cyber Security from recognized/university / Institution AND CISA, CISM, CISSP Post Qualification Experience: Minimum 4 years’ experience in financial sector, out of which 2 years should be in Banking – IT related areas/ projects involving IT Policy and Planning/ Financial Networks and Applications/ Financial Information Systems / Cyber Security Technologies / Payment Technologies |

| Vigilance | Educational Qualification: Post-Graduate Degree/ Diploma in Management OR CA / ICWA/ CFA from recognized University / Institution Post Qualification Experience: Minimum 4 years of experience in financial sector Preferred: 2 years experience in Vigilance functions in Banks/FIs |

| Internal Audit | Educational Qualification: Post Graduate in any discipline and CISA (Certified Information Security Auditor) Desirable: Certification course in information & cyber security Post Qualification Experience: Minimum 4 years of experience in financial sector Preferred: 2 years Audit/Compliance experience in areas like Banking / Accounting / Credit (in RBI regulated entity) |

| Compliance | Educational Qualification: Post-Graduate Degree / Diploma in Management with Specialization in Finance / Banking & Finance OR MBA (Finance/Banking & Finance) OR ICWA / CA from recognized University / Institution Desirable: CIA, Certified Accounting & Audit Professional from IIBF Post Qualification Experience: Minimum 4 years of experience in financial sector Preferred: 2 years Audit/Compliance experience in areas like Banking / Accounting / Credit (in RBI regulated entity) |

| Accounts | Educational Qualification: Post-Graduate Degree / Diploma in Management with Specialization in Finance / Banking & Finance OR MBA (Finance/Banking & Finance) OR ICWA / CMA / CA from recognized University / Institution Desirable: CPA, CFA Post Qualification Experience: Minimum 4 years of experience in financial / corporate sector; out of which 2 years in accounts and taxation |

| Strategic Development and Partnerships | Educational Qualification: Post-Graduation Degree in Economics OR Post-Graduation Degree/ Diploma in Management with Specialization in (Finance / Banking & Finance/ Sustainability Management/ Strategic Management) from recognized University / Institution Post Qualification Experience: Minimum 4 years of experience in financial sector / consultancy firm Preferred: Experience in Corporate Strategy / Business Strategy / Business Process Re-Engineering / Partnerships |

| Experience: Position-wise Post-qualification experience of 4 years for all the above positions in Senior Analyst grade is mandatory. | |

Below are the Functional Area & Indicative Job Profile for NaBFID Recruitment 2024 of Officers – Senior Analyst Grade:

| Stream [Functional Area] | Indicative Job Profile / Desired Skills |

|---|---|

| Lending Operations [Presales, Proposals and Appraisal & Syndication] [Disbursement, Monitoring & Follow-up] [Operations] | Contribute towards all proposals end to end to ensure that all necessary stipulated conditions are complied with and to review the credit behaviour of all portfolio accounts. Understanding of policy / process formulation and implementation, laying down systems and procedures for credit monitoring related matters in a large organization. Any other work assigned by NaBFID |

| Human Resources [Human Resources] | Responsible to manage various aspects of employee management and support, managing and implementing the performance management, recruitment & selection, compensation, and benefits, learning and development, employee relations and other HR operations, systems in line with NaBFID’s growth aspirations and business plan. Sound understanding of employment laws and statutory regulations. Knowledge of regulations pertaining to reservation policy. Any other work assigned by NaBFID. |

| Investment & Treasury [Resource Raising] [Treasury – Back Office] [Treasury – Front Office] | Responsible to implement NaBFID’s resource mobilization strategy in line with the objective of creating a robust balance sheet which can support large scale infrastructure projects in the Country. Responsible for settlement & accounting of all treasury trades, reconciliation and balancing of books, valuation of securities and ensure timely submission of regulatory statements, audit & MIS. Manage the allocated capital in line with the framework of investment policy at NaBFID. The role would entail investment & portfolio management, liquidity management, and ensure cash flows are in line with the business objectives of the Bank. Good understanding of fund-raising strategy and institutional resource mobilization Exposure to accounting and settlement of various trades and preparation of treasury balance sheet Exposure to finance and treasury activities, including banking, cash and liquidity management, and capital & debt markets, Any other work assigned by NaBFID. |

| Information Technology & Operations [Business Support & Project Management] [Technical Support] | Responsible for effective planning, establishing, and managing information technology (IT) projects. Ability to work on a cluster of technology platforms, continuously evaluate technology solutions, and induct cutting edge technology stack to drive business excellence at NaBFID. Ability to work in cross functional teams. Strong business, technical and analytical acumen Deployment & management of Information Security & Cyber Security tools / solutions / controls. Any other work assigned by NaBFID. |

| Administration [Facility Management] [Vendor Management] [Procurement] [Protocol Services] [Administration] | Facility Management – Co-ordinating with agencies to ensure proper and timely Housekeeping / Catering / Security / Electrical / Carpentry / Plumbing works, etc. Vendor Management – Contracting and ensuring uninterrupted services through AMC vendors. Travel desk management i.e., booking of taxi, flights, hotels, etc for official purposes of the dignitaries. Procurement – Purchasing stationery / consumables / property items, etc through GeM by floating RFP / direct purchase, etc as per Policy Protocol Services – Receiving / Seeing off Officials / dignitaries at Airport / Railway Station, etc on their domestic tour. Organising meetings / interviews / managing schedules. Administration – Responsible for providing administrative support. Maintaining and upkeeping of files / folders / stationery / consumables / assets. Organizing meetings / events, etc. Processing of bills / claims. Analysing records, creating reports, and assisting in day-to-day operations and functioning. Co-ordinating with internal departments and other stakeholders for smooth functioning of the office. Knowledge of General Financial Rules, Operations in GeM, Techniques of Recordkeeping, Basics of Accounts / Finance / Law (Contract Act etc), Ethics and Conflict Resolution. Any other work assigned by NaBFID. |

| Risk Management [Market, Liquidity & Interest Rate Risk] [Enterprise Risk Management] [Credit Risk & Policy] [Credit Monitoring] | Responsible for conducting stress tests, credit risk portfolio analytics, Internal Capital Adequacy Assessment Process. To ensure appropriate mechanisms to measure risk, structure risk mitigation into the business operations. Assist in design and implementation of Enterprise Risk Management Framework. Review and updation of risk related policies/manuals/ framework. Strong technical and analytical acumen. Good understanding of industry and risk management. Any other work assigned by NaBFID |

| Risk Management – Information Security [Information Security] | Deployment & management of Information Security & Cyber Security tools / solutions / controls Deployment, management & reporting of endpoint security controls & metrices Monitoring & management of Manged Security Operations Centre. Design, review & validation of security KPIs, KRIs, returns, reports etc. Implementation of established IS framework & controls to mitigate identified IS risks. Run IS awareness sessions & campaigns and provide training to the key stake holders. Any other work assigned by NaBFID. |

| Vigilance [Vigilance] | Contribute towards strengthening the internal vigilance machinery of NaBFID and ensure that measures are in place according to the guidelines set by the government authorities. The incumbent will also help towards preventing, detecting, and overseeing investigations pertaining to any allegations or instances of fraud and financial crime, from both an internal and external perspective Knowledge of financial products, frauds, and trends A good understanding of applicable legal statutes as they relate to financial crimes (including fraud, bribery, and corruption) and working knowledge in applying these laws. |

| Internal Audit [Internal Audit (IS Audit)] | Conducting risk assessment of entire Information Systems (IS) landscape, preparation of annual IS audit plan, Conduct IS Audits to assess the adequacy and effectiveness of implementation of established IS framework. Provide appropriate recommendations for the mitigation of identified IS risks. Identify and maintain a panel of external IS auditors. Supporting external IS auditors in delivering their audit work. Have experience in CAAT and VAPT tools. Any other work assigned by NaBFID |

| Compliance [Regulatory Compliance] | The incumbent is expected to possess a understanding of relevant regulations, such as AML and KYC, alongside analytical skills to scrutinize data and identify compliance risks. Effective communication skills are essential for articulating compliance issues and solutions to stakeholders, while problem-solving abilities enable analysts to address and mitigate potential violations proactively. Moreover, integrity and ethical judgment are fundamental to uphold the industry’s regulatory standards. Proficiency in compliance-related technology and a commitment to continuous learning and adaptation to evolving regulations are also key for success in these roles. Any other work assigned by NaBFID. |

| Accounts [Accounts] | Responsible for implementing NaBFID’s accounting and taxation policies, budgetary controls, preparation of financial statements, and compliance to tax guidelines and statutes. Well versed with accounting transactions in Accounting/ LMS packages. Ability to independently exercise judgement and stature to interact with varied internal and external stakeholders. Any other work assigned by NaBFID. |

| Strategic Development and Partnerships [Strategic Development and Partnerships] | Contribute towards defining the business strategy of NaBFID and outline the strategic roadmap for the organisation. Identify market trends and keep an eye on the competitive landscape. Assist in management of partnership life cycle etc. Evaluate partner contracts, and identify areas for improvement and potential risks, and effectively communicate the findings to legal and leadership. Evaluate and update the processes for finding, managing, and monetizing strategic partners. Any other work assigned by NaBFID. |

| Important Instructions for NaBFID Recruitment 2024: Before applying, candidates are requested to ensure that they fulfil the eligibility criteria for the position applied for as on date of Eligibility. Online examination for NaBFID Recruitment 2024 will be conducted in the following cities: Ahmedabad/ Gandhinagar, Bangalore, Bhopal, Bhubaneshwar, Chennai, Chandigarh/Mohali, Delhi/NCR, Guwahati, Hyderabad, Jaipur, Kolkata, Lucknow, Mumbai/ Navi Mumbai/ Thane/ MMR region, Nagpur, Raipur, Patna, Pune, Varanasi, Vijayawada, Thiruvananthapuram. The Examination Centers might get changed if sufficient number of candidates are not available or for any other administrative reasons. Interviews will be held at Mumbai only. | |

Structure of Exam for NaBFID Recruitment 2024:

| Name of Exam | No. of Questions | Max. Marks | Time (minutes) |

|---|---|---|---|

| Professional Knowledge | 50 | 100 | 60 Mins. |

| The Exam for “NaBFID Recruitment 2024 for Officers – Senior Analyst Grade” will consists of Multiple choice questions. Candidates will be given the option to respond either in Hindi or English Options per question in Objective Section: 5 options Penalty for wrong answer: ¼ marks assigned to that question will be deducted. The minimum Qualifying marks will be (i) 40% (35% for SC/ST/OBC/PwBD However, the bank reserves the right to waive/ modify the minimum qualifying marks without any prior intimation. | |||

Candidates are advised to regularly check the careers section of the Bank’s website www.nabfid.org for NaBFID Recruitment 2024 details and updates.